"The American Republic will endure until the day Congress discovers how to bribe the public with the public's money."

- Alexander Fraser Tytler

"The hardest thing to explain is the glaringly evident which everybody has decided not to see."

- Ayn Rand

Never in modern history has a voting majority confiscated so much from its children, by incurring so much debt to preserve its own excesses. Debt is simply a form of deferred payment which accrues geometrically compounding costs in the form of interest. Given the response of governments to the current economic downturn, and the acquiescence of voters to unprecedented government deficits, one is compelled to question the values and motives of contemporary citizens.

In fact, there are only three possible explanations. One involves a form of pervasive, illusory expectation in which this debt is somehow repaid during the voting public's remaining lifespan out of current meager savings. A second possibility is that voters are convinced that bailouts and record deficits are a better legacy for future generations than a period of retrenchment. Thirdly, existing voters may be ambivalent to the fate of future generations when faced with the alternative of thrift.

I will draw on simple math and personal experience to illustrate an important facet of the existing conundrum. It is well known in the financial planning community that, under optimistic assumptions, one's savings at retirement must be at least 20 times one's expected retirement income when adjusted for inflation. For example, a couple retiring at age 65 that requires a consistent $100,000 pre-tax purchasing power in retirement must have at least $2 million in savings. A $150,000 pre-tax retirement income, adjusted for annual inflation, requires $3 million in savings.

Source: Butler|Philbrick & Associates

Click image for larger version

The data suggests that just a small fraction of non-pensioned families have enough savings to support their lifestyle objectives in retirement. Many are ill-equipped to fund even a basic retirement under current lifespan assumptions. What proportion of people you know that are nearing retirement have an appropriate level of savings according to the above model?

Click image for larger version

In the public and private pension worlds, data suggests the situation is not much better. A majority of pensions, both private and public, were underfunded even before the current global bear-market. Companies, municipalities, and provincial and federal governments have deferred pension contributions for many years to avoid tax hikes or program cuts or, in the case of private companies, to enhance current earnings. This deferral serves the goals of politicians and company managers who are rewarded in the short-term for program and earnings largesse. These same people are unlikely to face the consequences of these actions during their terms. Worse, when stock and bond markets fail to meet performance expectations, as in 2000-2003 and 2008, politicians alter the rules to allow even greater deferrals to preserve corporate earnings or avoid raising taxes during challenging economic periods. The misguided hope is, of course, that an even more stressed and over-leveraged economy will provide such a boost to asset prices that managers can grow their way out of deficits. For many reasons, this is less likely now than ever.

One reason this is unlikely is that insufficient savings will produce one of two outcomes: higher savings in the years before retirement, or lower spending in retirement. Given that consumer spending represents around 60% - 70% of Gross Domestic Product in developed economies, a reduction in consumer spending due to higher savings rates and/or lower retirement incomes will surely cause much slower economic growth over the next several years. Further, the U.S. consumer is responsible for no less than 16.6% of total global GDP, followed by Japan (8.1%), China (7.3%), and Germany (6.0%).

Many people point to growth in relatively young emerging economies as a reason for optimism. Indeed, growth in these economies, under more likely global financial trajectories, may buffer the impact of lower spending in developed nations. However, there are significant hurdles that will limit the impact of emerging market growth. The first is the mercantilist structure of these economies. Growth in emerging markets has largely resulted from the migration of Western domestic manufacturing to lower cost jurisdictions. This migration, which is a mutually beneficial arrangement under the right (Schumpeterian) circumstances, is the first step in the evolution of any young economy into a mature capitalist democracy. The 'Asian Tigers', which include Taiwan, Singapore, South Korea and Hong-Kong, managed very rapid growth from the early 1960s through the 1990s by successfully leveraging this export-driven model to become mature capitalist states. China, and to a lesser degree India, have also adopted this model to support their aggressive growth ambitions. Unfortunately, demographic and secular forces have likely conspired to delay the best laid plans of Indian and Chinese central policy makers. They are unlikely to achieve the same level of prosperity on the same timeline, or using the same methods as the Asian Tigers.

Productivity is the degree to which a labour force can achieve higher output with a constant level of inputs. There are two ways to drive productivity growth: leverage and innovation. Innovation is a sustainable resource, limited exclusively by the creativity and courage of humanity. It is a function of risk-taking, which depends on a society's tolerance for failure. Leverage is the degree to which a society embraces debt to amplify growth. All economies can accommodate a degree of leverage, but the sustainable leverage ratio in an economy depends on economic productivity, flexibility, workforce mobility, ratio of services to goods, and other factors. This ratio is constantly changing, but the ratio should fluctuate in a slowly increasing range; it should not grow exponentially. The drawback to leverage is that it also amplifies the volatility of economic growth, with higher leverage leading to a higher degree of economic fluctuation.

Click image for larger version

Click image for larger version

Click image for larger version

Demographic forces related to the average age of a population largely influence the flexibility, creativity and productivity of economies. Leap-frog innovation generally occurs when the bulk of a population is in their early twenties and thirties. This is a point of maximum risk-taking, and risk is a necessary input to innovation. One must be willing to fail many times in the pursuit of a better mousetrap, and people in their twenties can more easily start over. People in their thirties and forties are focused on raising a family and accumulating domestic necessities such as shelter, transportation and early schooling for children. This necessitates a more conservative approach to life and career. As people move through their forties and fifties, post-graduate education for children becomes the priority, and lifestyle and retirement considerations enter the picture. These priorities limit risk-taking, which in turn limit innovation.

Source: Harry S. Dent, The Great Depression Ahead, 2009

Click image for larger version

The 'Baby Boomer' demographic cohort is generally considered to encompass the generation born between 1946 and 1964. Thus, the first Boomers entered their prime innovation years during the early 1970s, and innovation likely peaked around 1980. The Boomers rode the information technology innovation wave, which was pioneered by 5 people born between the years 1954 and 1956: Bill Gates (Microsoft), Steve Jobs (Apple), Steve Ballmer (Microsoft), Scott McNealy (Sun Microsystems) and Eric Schmidt (Sun Microsystems, Novell). The innovations developed and commercialized by these creative Boomers generated enormous productivity gains throughout the 1980s and early 1990s.

Another innovation wave that occurred during the 1960s and impacted the economy through the early 1990s was the rise of feminism and the migration of women from the home into the paid workforce. GDP growth is simply the product of the growth of GDP per capita (productivity) and the growth in the working population. The migration of women from the home expanded the pool of paid workers, as homemaking was not, and unfortunately still is not, recognized as productive labour in GDP calculations. This magnified the gains from the information technology innovation wave, and significantly contributed to Western GDP growth during this period.

Source: Bureau of Labour Statistics, Mckinsey Global Institute

Click image for larger version.

The Asian Tigers capitalized on this innovation wave by developing their economies around domestic high-tech engineering, and manufacturing for export to a prosperous and fast-growing Western population which was rapidly adopting microcomputers and networking. They were further fed by the maturation of the Japanese consumption wave and credit bubble, which peaked in 1989. Without these massive external demand stimuli, Asian Tiger economic prosperity would have never gotten off the ground. They benefitted from thirty-five to forty years of growing Western demand while an entire generation of ‘Tigers’ was educated, entered the workforce, and gained middle-class levels of prosperity. This pervasive middle-class prosperity is one of the key defining characteristics of a mature capitalist democracy.

Despite over a decade of 7%+ GDP growth, China and India are still a very long way from achieving the same level of economic prosperity as the Asian Tigers. Further, their domestic economies are still highly reliant on exports for economic growth. This combination makes them especially vulnerable to a slowdown in demand from mature Western economies.

China and India captured very little of the information technology innovation wave that crested in the early 1990s because their rapid economic growth did not begin until the early 1990s. Instead, these countries have relied on, and to a large degree financed, the phase of Western growth from the mid-1990s through 2007 that was based largely on an increase in leverage. In the period from 1993 through 2005, U.S. households went from saving 8% of disposable personal income to spending almost 1% in excess of disposable income. In the same period, U.S total debt to GDP, a measure of aggregate economic leverage, rose from 230% to over 350%. For context, the total leverage at the peak of the roaring 20s, before the 1929 stock crash, was 265%. It was 110% of GDP just prior to WWII, and rose to 143% at the peak during the war. This magnitude of debt creation is unprecedented in modern history, and is the legacy we leave to our children.

Source: CalculatedRiskBlog, Butler|Philbrick & Associates

Click image for larger version.

China and India, and to a lesser extent other developing nations in Asia, South and Central America, have relied on Western profligacy to sustain their economic ‘miracle’. The productivity benefits of innovation in Western countries peaked in the 1980s and early 1990s. Productivity gains experienced from the early 1990s through 2005 were largely, if not completely due to an expansion of debt ratios in developed economies.

If Westerners accrued so much debt, it is natural to ask, ‘who lent us all this money?’. The answer is that the export-driven economies of China, India, and Japan loaned Western economies money so that they could continue buying their exported goods. Chinese, Indians, and Japanese are excellent savers. The Chinese save almost 40% of their disposable income. Income earned from exports goes directly into savings, and this savings is lent to Western consumers so that they can continue to spend. This global vendor-financing arrangement suited everyone until Western consumers ran out of borrowing capacity.

Source: Brad Setser, Council on Foreign Relations

Western consumers felt comfortable spending more than they earned so long as their assets, in the form of homes and stock portfolios, were growing faster than their liabilities. Why should one save an extra $5,000 per year when the savings are dwarfed by the increase in the value of one’s home? If the value of one’s assets are increasing by $20,000 per year, why not spend the extra $5,000 on a vacation? Better yet, why not borrow $10,000 against the $20,000 increase in the value of the home to finance a down-payment on a car lease?

Homeowners extracted record amounts of equity from their homes over the past few years to finance lifestyles beyond their means. Thirty years ago, those Americans with mortgages owned 50% of the equity in their houses. Now they own less than 20%. At the peak in 2005, home equity withdrawals directly financed almost 10% of GDP! For many people, their home is their principal asset, and they relied on constant appreciation in the price of this asset to fund their retirement. With U.S. home prices down 25 or more percent from their peak, a record number of homeowners now owe more on their mortgages than their house is worth. This has had a devastating impact on people’s sense of wealth and stability.

Click image for a larger version.

Click image for larger version.

This same dynamic is at play across the globe, with property values down precipitously in many parts of Europe, the Middle-East, and Asia. Commercial properties, such as hotels, condominiums, and malls, are experiencing massive drops in value.

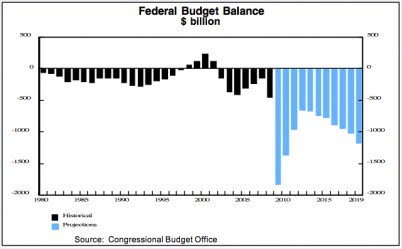

With consumers unable to increase their spending, governments around the world have stepped-in to fill the void. U.S. government deficit spending this year is a whopping 15% of GDP. Chinese spending and loan growth amounts to nearly 35% of GDP. U.K. and Japanese deficit spending is at record levels. Yet even with this record stimulus, GDP is likely to contract this year in all of the above countries save China. Put another way, government is stimulating the economy to the tune of 15% of GDP, but the economy is not growing. How much must the rest of the economy be contracting so that a 15% adrenaline shot can not kick-start growth?

It is important to recognize that deficit spending is nothing more than the government attempting to bribe its citizens with their children’s money. Deficit spending during times of economic weakness was first advocated by Keynes in the early 20th century. Keynes suggested that governments might attenuate normal boom and bust cycles in the economy by increasing spending during recessions to replace slack demand. Deficits incurred during these periods would then be paid back when the economy recovered.

Unfortunately, the 4 year political election cycle works against Keynes’ policy recommendations. When times are tough, politicians generally have no problem loosening the purse strings. However, when the economy is growing, politicians find reasons to cut taxes and expand programs rather than paying down deficits. Thus, Western democracies have spent over 80% of years since Keynes’ policies were first introduced incurring deficits despite the fact that the economy has been in growth mode more than 90% of the time.

At this point, one is likely asking, ‘So what is the solution?’ In this age of flu shots, antibiotics, high-fructose corn syrup, on-demand video, Rock-Star energy drinks, Ultimate Fighting, and 24 hour business news, it may come as a shock to discover that the answer can not be summarized in a 140 character ‘Tweet’ a la Twitter.

The inescapable truth is that the only sustainable solution to the current crisis is a prolonged period of retrenchment and slower growth around the world. Boomers will have to work longer to afford less robust retirement lifestyles. Unemployment will remain elevated for many years as producers adjust to a period of significantly lower aggregate demand. Enormous overcapacity in manufacturing and real-estate will result in low inflation and, for a while, deflation in the price of goods. People that lived beyond their means for many years will spend many years living below their level of disposable income as they use more of this income to pay off debt. Families will lose their homes and will end-up renting or living with family members. Income levels will fall across the spectrum, but incomes in the highest brackets, such as those of bankers and tort lawyers, stand to fall the most. People will travel less, camp more, golf less, and spend more time with their families. People in large cities will finally meet their neighbors, but they will gather for barbecued hot-dogs instead of Kobe strip-loins. Families may start raising their own children instead of outsourcing to day-cares and nanny services. Married children will be more likely to settle close to their parents to raise their families.

Notice that some of the above outcomes do not sound all that bad. In fact, during periods of economic retrenchment, cultures tend to get back in touch with core beliefs and values. Obesity levels and the incidence of stroke and heart-disease are reduced. Divorce is less frequent as individuals are less likely to perceive that the grass is greener elsewhere. This is bad news for ubiquitous divorce lawyers, but great news for community attachment, which in turn lowers levels of juvenile delinquency, and drug and alcohol addiction.

What does this mean for stock and bond portfolios? It almost certainly means that stock and bond prices are likely to drop substantially over the next few years once this rally runs its course in the next few weeks and months. Real return expectations must be lowered, and financial plans must be re-visited. Savings must replace portfolio growth as the means to financial independence. ‘Buy and Hold’ or, more accurately, ‘Buy and Hope’ strategies will prove disastrous for a while. Investors must position themselves to take advantage of large market swings rather than a long period of rising prices. Trading is in, investing is out.

In summary, global citizens have enjoyed an almost unprecedented period of economic prosperity and peace. This period was a natural consequence of several positive trends catalyzed by post WWII euphoria. Boomers drove an innovation wave in technology, and women around the world joined the workforce to drive a wave of GDP growth and productivity from the late 1960s through the early 1990s. Once innovation and the feminist movement crested in the early 1990s, Western citizens refused to curtail extravagant lifestyles born of prior innovation waves. Like an alcoholic who drinks coffee to keep the party going, Westerners turned to debt to sustain their excessive spending habits. But coffee can only delay the hangover for so long. One can hear the sirens in the distance. And when they raid the house of ill repute, even the good girls and the piano player go to jail.